Frequently Asked Questions

We help our community members thrive.

Peoples Advantage Helping Hands empowers people to achieve their financial dreams through personalized coaching and community services.

What is Peoples Advantage Helping Hands, and how can it help me?

Learn about our financial empowerment programs, including financial coaching, housing stability support, and small business resources designed to help you reach your goals.

Am I eligible for housing stability support or financial coaching?

Our programs are free and open to individuals and families in the Tri-Cities and Richmond area communities.

How can I support Peoples Advantage Helping Hands?

You can get involved by donating, volunteering, or partnering with us. Visit our Support Us page to learn how you can help strengthen financial stability in our community.

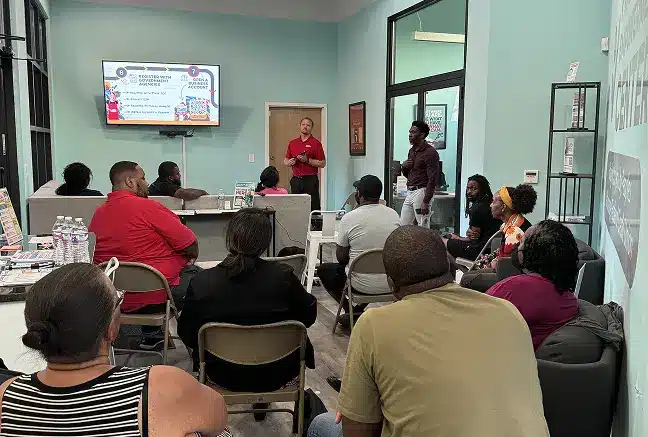

Our free workshops change lives

Our budgeting workshops are designed to empower individuals and families with the knowledge and tools to take control of their finances.

How do I sign up for financial coaching or attend a workshop?

Book coaching or call us at 804-748-3081 to schedule a free one-on-one financial coaching session or register for one of our upcoming budgeting or homebuyer workshops.

Can Peoples Advantage Helping Hands help me improve my credit score?

Yes! Our financial coaches offer credit-building education and one-on-one support to help you manage debt, build credit, and improve your financial health.

What kind of help is available for starting a small business?

We offer personalized coaching for aspiring entrepreneurs, covering topics like budgeting for your business, accessing capital, and managing credit to grow your business responsibly.

Is there a cost to participate in Peoples Advantage Helping Hands programs?

All of our workshops and financial coaching services are provided at no cost to participants thanks to the generosity of our community partners and funders.

More about our workshops

Frequently asked questions about our workshops.

How long are the workshops?

Most workshops are 1-2 hours and include time for questions and hands-on practice.

Do I need to bring anything to the workshop?

Just bring a pen and paper. We’ll provide worksheets and examples to help you get started.

What if I’ve never done this before?

Perfect! Our workshops are designed for beginners and we start with the basics.

Can I get help after the workshop?

Yes, you can schedule free 1-on-1 coaching to work on your specific situation and goals.

What if I can barely pay my bills now?

We’ll show you how to start small and find realistic ways to improve your financial situation.

How do I know which debts to pay off first?

We teach you how to prioritize high-interest debt while keeping up with minimum payments on everything else.

Will this help improve my credit score?

Yes, we show you specific steps to improve your credit and track your progress over time.

What credit score do I need to buy a home?

Most programs require 580-620, but we help you understand your options and work toward the best rates. Use this calculator to figure out your monthly rate.

How much do I need for a down payment?

Many programs offer 3-5% down payments, and we help you find down payment assistance in your area.

Do I need good credit to start a business?

Not always, but good credit opens more funding options. We help you improve your credit and find alternative financing.

How much money do I need to start a business?

It varies by business type. We help you create realistic startup budgets and find funding sources.

How long does it take to see results to my credit score?

Most people see changes in 3-6 months, but we help you understand what to expect based on your situation.

Top Resources for:

View all resources-

All Workshops

Join free group classes on budgeting, saving money, credit repair, and homebuying in the Tri-City area. -

1-on-1 Coaching

Get personalized financial coaching to improve your credit, manage debt, and reach your money goals. -

Support Us

Help us provide free financial coaching and housing support by donating, volunteering, or partnering with us.