Buy A Home with Financial Coaching

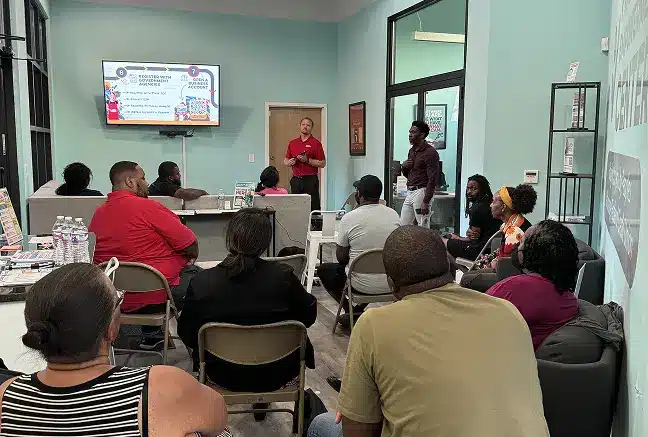

Our free workshops help you prepare for homeownership by improving your credit, managing debt, and understanding the home buying process. Join other Tri-City families working toward their first home.

We Help You Build the Credit and Savings You Need to Buy

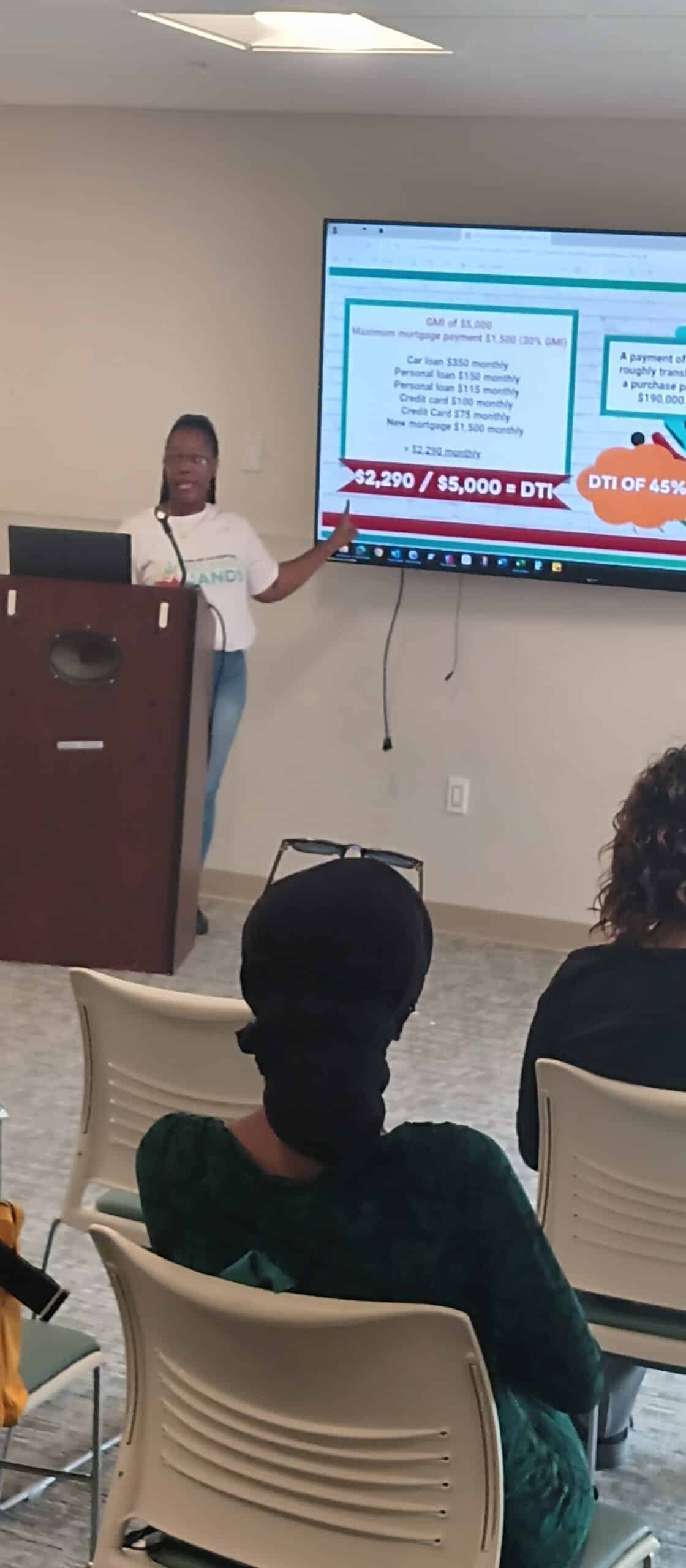

Learn how debt affects your mortgage approval, create a plan to boost your credit score, and budget for down payments and closing costs. We also connect you to local down payment assistance programs.

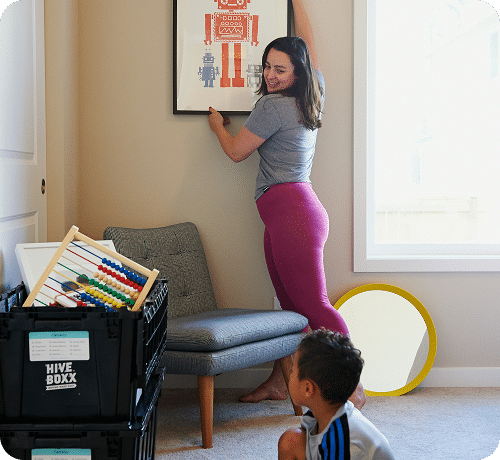

Get 1-on-1 Support Through Your Home Buying Journey

Work with a coach to improve your financial profile and stay on track toward homeownership. We help you understand what lenders look for and prepare for each step.

Our workshops are helping people thrive.

-

Preventing foreclosureWithout your help I would have faced foreclosure of my home that is almost paid in full. The $2100 put me back on track with my finances. I really would like to thank all of you for what you have done for me.”Housing Stability Participant

Preventing foreclosureWithout your help I would have faced foreclosure of my home that is almost paid in full. The $2100 put me back on track with my finances. I really would like to thank all of you for what you have done for me.”Housing Stability Participant -

Preventing evictionI share an apartment with my three young adult sons. We got behind on the rent to the point we were to be evicted. I spoke to Becky and told her the situation. What a blessing! Becky was so helpful and patient with us, especially with getting paystubs, letters from the rental office showing when the money was due before the eviction. This was a blessing, and I am forever grateful. Thank you for helping me and my family.”Housing Stability Participant

-

Keeping a family in their homeI want to say Thank You to you and Peoples Advantage Helping Hands program for everything you’ve done to assist me and my family. We were out of options and thanks to you we are able to keep our home!”Housing Stability Participant

Keeping a family in their homeI want to say Thank You to you and Peoples Advantage Helping Hands program for everything you’ve done to assist me and my family. We were out of options and thanks to you we are able to keep our home!”Housing Stability Participant -

Empowering business ownersI just wanted to say how much I enjoyed my coaching session. I walked away with an even greater sense of excitement about launching my business—and honestly, I didn’t think that was possible! I’ll be keeping an eye out for upcoming workshops, and I plan to officially join the Chamber of Commerce this week. Thank you again for your help in getting everything set up on the financial side. I truly appreciate the role you played in making sure I was ready for launch!”Entrepreneurship Participant

Ready to Take Control of Your financial future?

Get free 1-on-1 coaching to build your budget, improve your credit, and reach your financial goals. All our services are completely free for Tri-Cities area families.

Homebuyer workshops

Our workshops use real examples and give you tools you can use right away.

How long are the workshops?

Most workshops are 1-2 hours and include time for questions and hands-on practice.

What credit score do I need to buy a home?

Most programs require 580-620, but we help you understand your options and work toward the best rates. Use this calculator to figure out your monthly rate.

How much do I need for a down payment?

Many programs offer 3-5% down payments, and we help you find down payment assistance in your area.

How long does it take to get mortgage ready?

It depends on your starting point, but most people need 6-18 months to prepare their finances.

Do you help with the actual home buying process?

We focus on financial preparation, but we can connect you with trusted realtors and lenders.

More workshops

Whether you’re just starting to budget or ready to buy a home, our free workshops meet you where you are.

Top Resources for:

View all resources-

All Workshops

Join free group classes on budgeting, saving money, credit repair, and homebuying in the Tri-City area. -

1-on-1 Coaching

Get personalized financial coaching to improve your credit, manage debt, and reach your money goals. -

Support Us

Help us provide free financial coaching and housing support by donating, volunteering, or partnering with us.